Referring to Emiratisation as mere quotas is misleading – non-compliance comes at a high cost. In 2025, UAE private companies failing to meet Emiratisation targets face steep Emiratisation fines, licence restrictions, and reputational risks.

Over 152,000 Emiratis are now employed in private companies, and the government’s WPS system ensures real-time monitoring, automatically deducting fines for unfulfilled Emirati positions.

As H.E. Dr. Abdulrahman Al Awar, Minister of Human Resources and Emiratisation, stated: “The Emiratisation programme is not just a policy, it is a national priority that strengthens the competitiveness and sustainability of our labour market.”

This guide breaks down which Emiratisation fines apply, why they are issued, and how businesses can stay penalty-free in 2025 and beyond.

Emiratisation Law at a Glance

Understanding the rules that govern Emiratisation is the first step to avoiding penalties. The Ministry of Human Resources & Emiratisation now requires private sector firms with ≥20 workers to hire Emiratis at prescribed annual growth rates. Whereas, larger employers with more than 50 people on their staff team will be facing steeper targets and monthly e monitoring, if they are not complying. triggers automatic penalties in the Wage Protection System (WPS).

Companies are expected to not only meet quotas but also show their commitment to hiring, retaining, and developing Emirati talent. MOHRE continuously refines the framework based on economic changes, labour trends, and national targets.

Who Must Comply with Emiratisation?

- Private mainland firms with 20+ employees are required to meet Emiratisation quotas.

- Large firms with 50+ employees are subject to higher annual targets and closer monitoring.

- Exemptions exist for certain government-linked entities and very small (micro) firms.

- Free zones are gradually being brought under MOHRE’s jurisdiction, and companies operating there should prepare for inclusion in Emiratisation obligations.

Companies are expected not only to meet quotas but also to show their commitment to hiring, retaining, and developing Emirati talent. MOHRE continues to refine the framework based on economic shifts, labour trends, and national targets.

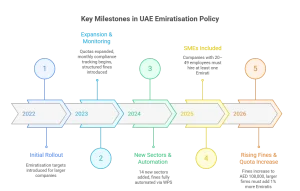

2025 Private Sector Hiring Quotas

- Firms with 20 to 49 employees are required to hire at least 01 Emirati national by the end of 2025.

- Those firms will have to hire another Emirati in 2026.

- For companies with 50+ employees, an annual increase of 1% in Emirati nationals is compulsory until 2026

- Companies that have a quickly growing number of employees will accordingly adjust their Emirati hiring

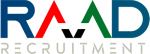

Timeline of Emiratisation Rules & Fines

The Emiratisation programme has been rolled out in stages, with new rules and higher fines introduced each year. Understanding this timeline helps businesses see how compliance has tightened over time:

2022 – Initial Rollout

Emiratisation targets were introduced for larger companies, mainly those with 50+ employees. The focus was on awareness, reporting, and encouraging private firms to begin hiring Emiratis.

2023 – Expansion & Stricter Monitoring

MOHRE expanded quotas and began monthly compliance tracking through the Wage Protection System (WPS). Penalties for non-compliance became more structured, moving from warnings to actual fines.

2024 – New Sectors & Automated Penalties

Fourteen new economic activities were added under Emiratisation requirements. Fines became fully automated, deducted directly via WPS. This marked the end of grace periods and manual payment options.

2025 – SMEs Formally Included

Companies with 20–49 employees were officially brought under the Emiratisation framework. These firms must employ at least one Emirati by the end of 2025, with another added in 2026.

2026 – Rising Fines & Quota Increases

Fixed fines per unfilled position will increase from AED 96,000 in 2025 to AED 108,000 in 2026. Larger companies must increase Emirati hires by 1% annually until 2026, and further expansions to free zones are expected.

Sectors Under Special Scrutiny

- High growth sectors are under MOHRE’s intensified scrutiny. These sectors include construction, finance, hospitality, logistics, real estate, and technology.

- Emiratisation’s scope is expanding. The free zones are also being gradually brought under MOHRE’s jurisdiction.

- Sectors with niche staffing needs, namely healthcare and fintech, are also expected to get in with the program.

- Sectors receiving government support are the ones expected to lead by example.

MOHRE Reporting & Inspection Cycle

- Monthly tracking is enforced via the Wage Protection System.

- Reports should include accurate headcount, salary details, and employment classifications.

- Inspections can be random or targeted based on WPS anomalies or past non compliance.

- E services portals offer self reporting options, but errors or omissions can still trigger audits.

- Some companies receive site visits or document requests without any prior notice.

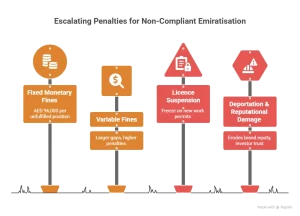

Types of Emiratisation Fines & Penalties

Non compliance comes at a high cost, and with escalating consequences. Businesses that ignore their Emiratisation obligations face immediate financial penalties, administrative restrictions, and longer term damage to their operating capacity. Fines are layered, automated, and in some cases, irreversible if they are not addressed on time.

Fixed Monetary Fines

- AED 96,000 is charged for every unfulfilled Emirati position per year.

- This fine will rise to AED 108,000 in 2026.

- Payments are debited directly from the company’s WPS linked account.

- Partial compliance does not negate the fine; it’s applied proportionally.

- Not maintaining Emirati hires (e.g., due to attrition without replacement) still counts as non compliance.

Fine Calculation Examples

Understanding how fines are calculated makes it easier for businesses to forecast risks and budget accordingly. The penalties are tied directly to the number of required Emirati hires that are missing, and they increase each year. Below are some practical examples:

Example 1: SME with 25 Employees

- Quota requirement (2025): 1 Emirati hire

- Actual hires: 0 Emiratis

- Fine imposed: AED 96,000 for 2025

- If the firm continues non-compliance in 2026, the fine increases to AED 108,000.

Example 2: Large Firm with 200 Employees

- Quota requirement (2025): 4 Emirati hires (1% of workforce)

- Actual hires: 2 Emiratis

- Shortfall: 2 Emirati positions

Fine imposed: 2 × AED 96,000 = AED 192,000 for 2025

Variable (Scalable) Fines for Large Gaps

- If a company misses 50% or more of its quota, the penalty is scaled using a multiplier formula.

- Larger firms with bigger gaps pay significantly more.

- Repeat offenders may lose access to government subsidies and hiring incentives.

- These fines may increase in severity over multiple years of missed targets.

Administrative Penalties: Licence Suspension/Revocation

Repeated breaches trigger MOHRE “black list” status and a freeze on new work permits.

- Companies that chronically underperform risk blacklisting by MOHRE.

- Blacklisted firms face suspension of new work permits and may be barred from participating in tenders.

- In extreme cases, commercial licenses may be revoked.

- Companies under investigation can get flagged for additional inspections across other departments.

Ancillary Consequences: Deportation & Reputational Damage

Key managers can be barred or removed. And the negative press affects brand equity and investor trust.

- Key foreign HR or executive personnel can even be deported on MOHRE’s order

- Press releases or media leaks can erode brand equity

- Investors, clients, and partners will most likely have to reconsider working with non-compliant businesses

- Job listings from fined or suspended companies can get deprioritized by recruitment platforms

Common Compliance Pitfalls

Most of the fines stem from a handful of errors that could have been totally avoidable. These unintentional errors across different industries and company sizes can be easily fixed with some proper oversight.

The most common compliance issues involve reporting inaccuracies, delayed actions, or hiring shortcuts that are in violation of the law. Knowing these can help businesses preemptively minimize risks.

Missing Monthly Quota Check points

- Employers often track progress annually when MOHRE evaluates performance monthly.

- A single month of non compliance can trigger a fine.

- Even small firms must ensure real time tracking and role fulfilment.

Late or Inaccurate MOHRE Reports

- Incorrect or incomplete workforce data submission can get businesses flagged

- Errors in salary amounts, job titles, or ID numbers can cause WPS rejection

Hiring Expatriates Without Valid Permits:

- Onboarding foreign workers without having proper documentation violates multiple regulations.

- These infractions invite extra scrutiny on Emiratisation obligations.

- Firms using freelance or consultancy contracts to bypass visa requirements can be penalised too.

Delayed or Under Paid Emirati Salaries

- Emirati workers should receive their competitive and timely salaries as per WPS records.

- Any discrepancies that are detected will be fined without a warning.

- Payment issues can impact the company’s WPS score and block their new visa requests.

The New Rule Enhancements: What Changed in 2024–25?

For increasing transparency and reducing any existing loopholes, UAE’s government introduced stricter enforcement mechanisms in 2024. Creating real and sustainable employment was the main goal. The ones mainly affected by these updates are SMEs and firms operating in niche sectors.

Enforcement of the emiratisation initiative has been tightened by the recent cabinet resolutions. The fines are now linked to WPS payroll data. Emiratisation quotas have now expanded to 14 new economic activities. Penalties with annual rising rates have been introduced, as well.

Automated WPS Deductions:

- There is no manual payment process or grace period.

- Fines are now deducted automatically based on WPS data.

- Notifications are sent through MOHRE portals and SMS.

Graduated Targets for SMEs

- New rules now apply to SMEs with 20 to 49 employees.

- There are staged targets now for SMEs: They should onboard one Emirati hire in 2025 and another in 2026.

- SMEs might qualify for targeted NAFIS benefits to support early adoption.

- Non-compliance will invite fines starting January 2026.

Industry Specific Enforcement

- 14 new sectors were added to the Emiratisation target list in 2024.

- Targeting includes digital media, education support, and green energy.

- Businesses should check if their trade license is under any of those expanded activity codes.

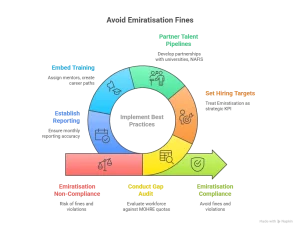

Best Practice Roadmap to Avoid Fines

The best practice here is being diligent with your Emiratisation compliance. And that’s certainly more effective than having to later fix all the afterdetects of violations. Here is a roadmap for what businesses, like yours, should do to prevent the Emiratisation fines.

Conduct an Emiratisation Gap Audit:

- Evaluate your workforce against MOHRE quotas.

- Identify roles that could be transitioned to qualified Emiratis.

- Document action items and risk exposure to share with stakeholders.

Set Realistic, Board Approved Hiring Targets

- Treat Emiratisation as your strategic KPI.

- Engage senior leadership to track progress monthly.

- Report progress to the board and adjust forecasts quarterly.

Partner With Emirati Talent Pipelines

- Develop partnerships with universities, NAFIS, career expos, and youth training programmes.

- Look up government funded internships and wage subsidies.

- Collaborate with local chambers of commerce and educational councils.

Embed Training, Mentoring & Career Paths

- Assign internal mentors to onboard Emirati hires.

- Create roadmaps for career advancement to boost retention.

- Offer online courses and leadership workshops focused on upskilling nationals.

Establish Monthly MOHRE Reporting Routines

- Use compliance software or dedicated consultants to ensure monthly reporting accuracy.

- Schedule internal check-ins around MOHRE’s evaluation cycles.

- Build a shared compliance calendar with your HR, finance, and legal departments.

How to Check Emiratisation Fines Online?

- Go to the MOHRE e-services portal → https://www.mohre.gov.ae

- Log in with your establishment credentials (company code, user ID, and password).

- From the dashboard, click “Compliance / Emiratisation Quotas.”

- Review your quota status: required Emiratis vs. actual hires.

- Check the fines section to see any penalties automatically deducted via WPS.

- Look for SMS or portal notifications for real-time updates on compliance status.

- Download reports for record-keeping or for use in appeals if needed.

How to Appeal an Emiratisation Fine?

- Log into MOHRE’s online dispute resolution portal using your establishment account.

- Locate the fine notice under the “Compliance / Penalties” section.

- Click “File an Appeal” and select the fine you wish to contest.

- Upload supporting documents such as:

- Emirati employee contracts

- WPS salary payment records

- Resignation letters (if an Emirati left the role)

- Any other evidence proving compliance

- Submit the appeal and receive a reference number for tracking.

- MOHRE typically reviews cases within 30–45 days and communicates the outcome via portal and SMS.

If rejected, you may escalate the case to a higher dispute committee or labour court for final resolution.

Support & Resources

MOHRE’s e-services portal, NAFIS wage support scheme, and sector specific chambers all publish their live guidance. MOHRE also offers an entire suite of digital tools, including real time dashboards and document templates. These have been made available to help companies stay compliant with the Emiratisation program.

The NAFIS programme provides financial support for hiring Emiratis, covering part of their salaries, training costs, and social contributions.

Various industry associations also host workshops, webinars, and mentorship schemes aimed at facilitating Emirati inclusion.

For tailored assistance, firms can turn to consultancies like RAAD Recruitment, which offer gap audits, recruitment support, and end to end compliance planning. We offer turnkey audit, recruitment, and reporting solutions that keep fines at zero.

Emiratisation Quotas & Penalties Timeline (2024–2027)

| Year | Key Rules | Emirati Hiring Requirement | Fine per Missing Emirati | Notes |

| 2024 | Expansion of sectors (14 new industries added) | Firms with 50+ staff → +1% Emiratis | AED 84,000 | Stricter WPS-linked monitoring begins |

| 2025 | SMEs (20–49 staff) formally included | SMEs → 1 Emirati hire | AED 96,000 | Automatic WPS deductions, monthly checks |

| 2026 | Quota increase continues | Firms with 50+ staff → +1% more Emiratis; SMEs → 2 Emiratis total | AED 108,000 | No grace period; penalties escalate |

| 2027 (Projected) | Expansion to free zones & new high-tech sectors | Quotas may rise further depending on sector | Likely > AED 108,000 | MOHRE expected to tighten enforcement further |

Conclusion

Ignoring Emiratisation means inviting severe consequences: steep penalties in UAE that can strain your finances, along with a tarnished reputation that may take years to repair. But where there are consequences, there are also incentives and government support to help businesses comply.

When your workforce is compliant, invested in local talent, and diverse, the payoff is significant – both in reputation and financial benefits. Build those hiring pipelines now. Partner with RAAD Recruitment to design a mitigation plan before your next MOHRE inspection.

FAQ

How Are Emiratisation Fines Calculated for Partially Met Quotas?

Emiratisation fines are calculated based on how much of the quota is achieved versus missed.

Is There a Grace Period for New Companies Before Penalties Apply?

New firms usually get a 1 year grace period, starting from the date of their licensing.

Can a Firm Appeal or Reduce an Issued Fine?

Yes, you can file an appeal through MOHRE’s online dispute resolution portal.

What Subsidies or Wage Support Programmes Offset Compliance Costs?

NAFIS offers wage top ups, onboarding support, and training cost reimbursement for Emirati hires.

Do Free Zone Companies Have to Meet Emiratisation Quotas?

Currently, most free zones are exempt from Emiratisation quotas. However, MOHRE has indicated that inclusion is coming gradually. Businesses operating in free zones should prepare for eventual compliance, as future regulations may extend quotas and fines to cover them.

What Happens if An Emirati Employee Resigns?

If an Emirati employee resigns, the company is still responsible for filling the quota position. MOHRE usually provides a short grace period, but if the role is not replaced quickly, the company may still face Emiratisation fines for non-compliance.

Are Part-Time Emiratis Counted in Quotas?

Yes, part-time Emiratis can be counted toward quotas if they meet MOHRE’s minimum working hours and contract conditions. Companies must ensure the employment contract is officially registered. Otherwise, part-time hires may not qualify, and fines could still apply for unmet targets.

Can Outsourcing Companies Include Emiratis Under Their Clients’ Quota?

No. Emiratis hired through outsourcing or third-party staffing providers cannot be counted toward a client company’s Emiratisation quota. Only Emiratis directly employed under the company’s official trade license and registered with MOHRE are eligible to fulfill Emiratisation requirements.

How Quickly Are Fines Deducted Once Triggered?

Fines are automatically deducted through the Wage Protection System (WPS) on a monthly basis once non-compliance is detected. This automated process leaves little room for delay, meaning companies immediately feel the financial impact of failing to meet Emiratisation quotas.